Today I have been thinking about Prediction Markets, and thought I would share some thoughts on how the Decision Engine could be designed to behave very much like a Prediction Market.

If you aren’t familiar with prediction markets, check out this explanation from Argon Group.

Verifiable Events

Prediction markets rely on events that will at some point in the future be objectively and unambiguously verifiable (e.g. who won a game, who was elected president). The Decision Engine, on the other hand, is designed for making predictions or decisions on questions that may be matters of opinion or judgement, with no external way of judging correctness of that decision. So how could the Decision Engine resemble a prediction market?

The Consensus Index as Market Price

The answer is the

consensus index, which is a measure of the consensus on any question. As a discussion proceeds and supporting- and counter-arguments are introduced, discussed, validated or discarded, people's opinions will change. But (and this is a key aspect of the Decision Engine's design) it will be calculated not as the percentage of participants that agree/disagree, but the probability that a participant will agree/disagree after reading all the arguments.

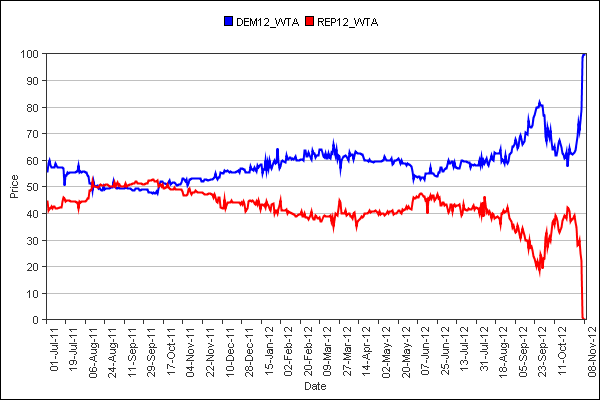

The Consensus index will tend to change over time, especially as people introduce convincing arguments. It is this difference between the initial, pre-argument consensus index and the final consensus index (determined by some stopping condition such as time or stability) that makes for the possibility of an interesting prediction market.